How Much Do You Really Need to Retire in America Today?

Buckle up, buckaroos…

We’re going to talk about exactly how much you need to afford retirement, and when you can reasonably expect to retire based on your current wealth.

Don’t worry, though…

You’re not going to have to read this whole thing or understand any of the complexities behind this number.

I’m going to tell you exactly how much cash you need in the bank to retire in America today.

Are you ready?

Here is the exact amount:

$4,014,150.

There you go. If you have $4 million, you should have more than enough to quit working, retire now, and afford an average lower-middle class lifestyle for the next 45 years or so.

Ok. Go make that money. Good luck. Bye bye now.

Not satisfied with that answer?

I’m not surprised. It’s a lot of money.

I’m sure there are people out there (not you, of course… you’re cool) going:

“Ok but, like, for real now. How much do I really need to retire? Can I get a quick summary or a TL;DR?”

Now, real talk…

If you’re the type of person who just wants a simple explanation to complicated questions (such as how much one needs for retirement)…

Or you’re the type of person who asks for a TL;DR (internet-speak for “too long; didn’t read”)…

You probably won’t succeed at retiring. Just like you won’t succeed at most things in life.

Truth hurts.

And that’s… kinda the problem when we talk about retirement.

Retirement is an especially unique blend of things that human beings are really, really bad at wrapping their heads around:

Uncertainty - Humans love concrete prescriptions and uncertainty causes a lot of stress, but retirement planning has a lot of variables, known-unknowns, and unknown-unknowns.

Subjectivity - Humans believe that what’s true for us is objectively true for everyone else regardless of context, even though it is not. And the path to “retirement” looks different for every individual, requiring different considerations.

Incremental Changes - Humans are great at reacting to immediate problems, but terrible at responding to problems that require small, gradual, consistent actions that accumulate over time. Retirement in the future means you have to take almost unnoticeable steps today that won’t feel like they’re paying off for a long time.

Numbers Larger than 4 - Human brains can fully understand five numbers: One, two, three, four, and “many.” Retirement costs huge quantities of money, and when confronted with these big numbers people tend to get overwhelmed or feel defeated.

The Future - Humans assume that what’s true now and the person we are now will remain consistent, but no one can correctly imagine or anticipate what our future selves or values will look like. So the “retirement” we envision now will almost certainly not be the retirement we actually experience.

Also, dare I say…

Talking about saving for retirement is boring. Super boring. Big ol snoozefest. I’m already yawning as I write this.

So if you want a simple one-person, no-family, modest-lifestyle retirement target this year?

You need $4,014,150 in cash.

And that’s not net worth. That’s the amount of liquid cash you need in your bank account or mattress.

The calculations that went into that large number, by the way (I’ll explain where it comes from in a second), is what inspired the purposefully provocative title of my post “You Will Never Save Enough Money to Retire.”

But if you want a better, more reasonable and realistic target?

And I mean you REALLY want to understand how to plan for retirement?

Then we need to roll up our sleeves and put some skullsweat into the problem.

So for everyone else who’s ok with going deeper and putting in the work, let’s walk through the complexities around saving for retirement.

So What’s The Real Answer? What’s the “Magic Number” I Need to Retire?

The inspiration for this blog post came from watching a ton of YouTube videos, reading a ton of blogs about this subject, using a ton of retirement calculators…

And being sort of disappointed in all of them?

But also, this disappointment is nothing new.

I actually ran into this problem years ago, when I was tasked with ghostwriting the step-by-step portion of a report for Palm Beach Research Group to help readers find their “Magic Number.”

The “Magic Number,” of course, being the exact number of dollars one needs to retire.

(By the way, the story I’m telling should prove instructional for anyone thinking about retirement as well as anyone who wishes to write about financial topics.)

“Keep it simple and understandable,” I was instructed.

Cool. Simple. Finance Not-Yet-a-Daddy is on the case.

If you want a simple method of calculating how much you need to retire, it’s a multiplication problem:

YEARS IN RETIREMENT x THE YEARLY COST OF YOUR RETIREMENT

If you want to have a 40 year long retirement, you multiply 40 by the amount you expect to spend every year you’re retired.

The average American spends $61,749 per year.

So if you want an “average” retirement lasting 40 years, beginning today, you only need 40 x 61749 = $2,469,960.

See? Easy peasy.

Just get your hands on $2.5 million and you can retire.

“This doesn’t factor in inflation,” is the feedback I got. “Try again.”

Big oof.

Inflation: the wealth killer.

The value of money trends downward over time by about 2% each year (we hope). In reality, it’ll probably be closer to or higher than 2.5% going forward–at least for the next few years.

Ok. So this arithmetic problem has become a sum of a finite geometric series problem.

Sweet. I’m good with numbers. We just need to factor inflation into the formula:

YOUR YEARS IN RETIREMENT x (THE YEARLY COST OF YOUR RETIREMENT x (1 + INFLATION) ^ YOUR YEARS IN RETIREMENT))

That means, by the end of 40 years, your lifestyle cost will be 61749 x (0.02+1)^40 = $136,344.

So the amount someone needs for retirement is actually 136344 x 40 = $5,453,760, right?

That’s the number. $5.4 million. Final answer.

“That’s ridiculous,” was the feedback.

“People don’t just hoard cash and spend it until they die. People want to invest it so they can live passively off that income. Find out THAT number. How much someone needs to invest to live off their investments.”

Well, balls.

But, I thought, it’s ok. Let’s figure out how we can do this using a stock's dividend yield.

See, when you buy a stock or invest in a fund that pays a dividend, you will, every quarter or (rarely) every month, get paid cash.

Just for owning a thing and doing nothing!

Dividends are the best and I will fight anyone who disagrees with me.

You get dividends because you’re a part owner in a business, and mature businesses distribute some of the money they earn back to their owners.

The percentage of income you get for owning 1 share of a stock relative to its price is called the “annual dividend yield.”

Meaning, if an ETF for the S&P 500 (SPY) pays you $5.72 over the course of 1 year, and its price is currently $468.66…

Then its yield is 5.72 / 468.66 = 1.2%.

(If you’re skimming at this point, you now understand what I was saying before about how this topic is 1) really hard and 2) super boring.)

So, ok!

If we want to live off dividend income alone in retirement, it’s just the previous formula, and a little bit of algebra.

(THE YEARLY COST OF YOUR RETIREMENT x (1 + INFLATION) ^ YOUR YEARS IN RETIREMENT)) / YOUR EXPECTED PASSIVE ANNUAL INCOME YIELD

Crunching the numbers, we get $136,344 / .012 = $11,362,000.

There you have it!

$11,362,000.

That is how much you need to have invested in the S&P 500 to generate enough income that you fully cover the cost of your retirement, so you never have to spend down your nest egg. Plus, inflation is factored, so you don't need to worry about that destroying your wealth.

“Wrong. That number is way too high,” is the feedback I got.

“People spend less in retirement. Also it doesn’t factor in the amount people have invested TODAY that will grow before they hit retirement. It also doesn’t factor in how much it will grow or how much income it will kick off while they’re retired. Oh, and it doesn’t factor in a pension or Social Security. And it doesn’t include the amount of cash people have… or the amount that people are saving and investing each month. Start over!”

At this point, I’d like to throw in, dear reader, that except for a brief stint as a Math major, I graduated with a Bachelor’s and Master’s degree in English, as well as a Master’s in Fine Art, and everything I had learned about good investing came from people who couldn’t make a financial model if their lives depended on it.

All this math so far is stuff I learned from textbooks for people looking to become Certified Financial Planners or Quantitative Investment Analysts.

So anyway, I’d been working on this report for weeks, and I had to start over again.

Other work was piling up and there I was, sitting for 14 straight hours in Subculture Coffee in West Palm Beach trying to come up with a simple, do-it-yourself way for people to accomplish something that even certified professionals need a computer for.

The person giving me feedback didn’t know, understand, or care that the question “How much do I need to retire?” is incredibly complex and nuanced.

Like I said before, human brains are poorly suited for these kinds of things.

This is why almost every retirement calculator or article about coming up with your retirement target is terrible, and why they will always be bad.

The question “How much money will I need for retirement?” is a calculus problem wrapped in a Monte Carlo problem.

It’s a muddled mix of functions that ends up producing something that’s less of a number and looks more like this:

It was still my job, regardless, to make it easy for people.

So… I started over…

And what I ended up with was a hot mess.

But I was determined to make something that gives some kind of answer to this question.

So this week, I built a calculator that factors in as many of the major variables as I reasonably could.

(That is an actual recording of me making the dang thing.)

What I ended up with is one Excel spreadsheet with two calculators…

The Simple Retirement Calculator…

If you're looking for a general ballpark without having to do too much work to input variables, this is your calculator.

But if you're in full-on planning mode and want a clearer roadmap…

There’s also The Ultimate Retirement Calculator...

So far, I’ve only shown it to friends and colleagues.

Kiara, DIYwealth’s acquisition copywriter and social media manager, had this to say about it:

“The functionality is great! My husband just did it and compared it to his TRowe retirement calculator and said this was more informative.”

So… that made my day. (Thanks Kiara!)

Let’s walk through using it so you can, ballpark, see how much you really REALLY need to retire.

STEP 1: Input Your Age, the Age You Want to Retire, and the Age Your Expect Your Retirement to End

Edit the numbers here in either the Simple or Ultimate calculator to your liking:

Your current age is how old you are. In years. (Just… making sure we’re clear on that.)

Your desired retirement age is the age you wish to stop working. (The full retirement age for most people is 65 to 70.)

And your expected end of retirement is the age you will die, which might be morbid but is something we’ll all have to contend with. (The life expectancy in the U.S. is 79, but if you make it to 65 you will, statistically, probably make it to 85, I hope.)

Once you plug those in, the calculator will tell you how many years you have to go before retirement and how long you expect your retirement to be.

STEP 2: Input How Much You Plan to Spend Per Year in Retirement, and How Much Cash You Currently Have Saved

Edit the numbers here in either the Simple or Ultimate calculator:

Your “current savings” are the “liquid assets” you have.

Liquid assets are the cash in a checking or savings account, cash you have stuffed in your mattress, or any assets you plan to sell before you retire.

Your “Expected Yearly Retirement Expenses” is how much you plan to spend, in this year’s dollars, every year that you’re retired.

The average American spends $61,749 per year. But folks 65 and older spend $48,106 per year on average.

Basically, if you want a lavish lifestyle or if you support multiple people, put a bigger number into this cell. If you want something more minimalistic or plan to move somewhere with a lower cost of living, put in a smaller number.

And with the Simple Retirement Calculator… that’s all you need to do!

You’ll see a calculation in the spreadsheet that looks like this:

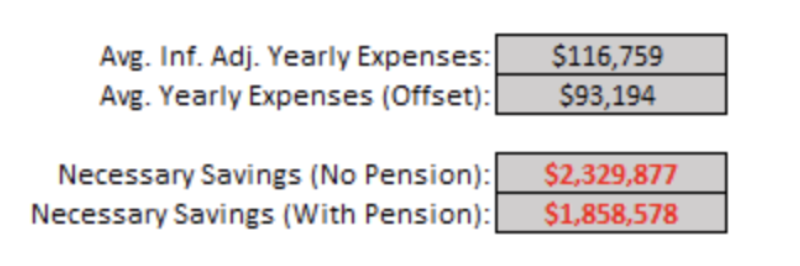

Your “Average Inflation-adjusted Yearly Expenses” is what you put in for your “Expected Yearly Retirement Expenses,” adjusted for inflation and averaged out over the expected length of your retirement.

The “Total Cost of Your Retirement” is just those yearly expenses, adjusted for inflation, added together.

This is how I got that $4 million I used to scare readers to attention at the beginning of this report:

The “Savings per X to Hit Target” are just the Total Cost of Your Retirement divided by the number of years, months, or weeks you have until you retire.

That’s it. That gives you the rough ballpark of what your retirement will cost.

But if you’re investing now and you expect to get a pension or Social Security, slip over to the tab that says “Adv Ret Calc” and we’ll factor those in.

STEP 2.5: Input How Much Cash You Currently Have Saved, How Much You Currently Have Invested, How Much You Invest Per Month, and What Return You Expect to Get On Your Investments

This is where the Ultimate calculator becomes… complicated…

And also will require some estimating and guesstimating on your part.

The Current Cash Savings? Same as before. This is obviously cash you don’t need to earn for retirement later, because you already have it.

The “Current Investments” should be a ballpark estimate of your investment portfolio. This could include stocks, bonds, crypto, real estate… Basically the total current value of any asset you’re personally invested in.

The “Average Monthly Contributions” is how much you plan to invest per month from today until you retire. If you’re just using an IRA, the contribution limit on that is $6,000 per year, or $500 per month.

And the “Expected Return on Your Investments” is a TOTAL guess, because no one can know what their future returns will be. Historically, the S&P 500 has generated about 10% on average, while the average retail investor earns about 3.66% to 6%.

If you are one of the absolute best investors in the world with no equal, struggling to handle the weight of your copious brainmeat, you might be able to justify putting 18% or more in that cell.

Once you put this in, you’ll see what you can expect your retirement “nest egg” to grow to by the time you begin retirement:

That’s an important number.

If it’s bigger than your “Necessary Savings” number, farther down the spreadsheet, then you will probably have enough money to cover your whole retirement without any issues.

Also, I calculated it so that this number continues to grow at your expected growth rate, even if you’re drawing cash from it to cover your expenses. So that will be accounted for at the very bottom of the spreadsheet if you see this message:

STEP 3: Input Your Expected Social Security or Pension Payment and the Age You Expect to Begin Receiving It

If you’re one of those… optimistic folks who believes they’re going to receive their Pension or Social Security payment in the future… Put it in here:

Plug in the age you expect to begin drawing Social Security or your Pension (the earliest age you can begin getting Social Security is 62 in the U.S.).

The “Annual Pension/SS Payment” is how much you plan to get paid per year (the average payment is $1,500 per month, or $18,000 per year).

And the “Expected Yearly Inflation Rate” is what you expect the annual inflation rate to be going forward.

The U.S. Federal Reserve Bank tries to keep inflation at about 2%, but I have it set to 2.5% because we’re going through a period of high inflation right now (it was 6.8% in 2021!) and it will probably be high for another year or two.

If you play around with this number, you’ll see why every fraction of a percentage point above 2% gives you 100 reasons to be absolutely livid with the U.S. Federal Reserve Bank…

Because that’s how much your hard-earned wealth is being eaten away by bad policy and economic mismanagement.

STEP 4: Check Your Necessary Savings so Far, and (Optional) Put In Your Estimated Yield if You Desire a Fully “Passive Retirement”

As with the Simple calculator, you’ll see how much your inflation adjusted expenses will be, and how much they’ll be if you offset them with a pension or Social Security:

The “Necessary Savings (No Pension)” is your yearly expenses, adjusted for inflation, added together, and minus your current savings.

The “Necessary Savings (With Pension)” is your yearly expenses, adjusted for inflation, added together, and minus your current savings and the present value of your pension/Social Security payments.

Now, you could read this as the amount of cash you need to have to pay for your whole retirement…

But if your money is invested, it’s much more complicated than that.

The value of your investments grows or declines independently of how much you withdraw to cover your expenses.

So plug in your expected “Passive Investment Retirement Yield” here (this is the dividend yield I introduced to you before, but it could just as easily be the yield you’re getting on a rental property portfolio):

The historical average yield of the S&P 500 is 2%...

But if you want tax free dividends, go for the iShares National Muni Bond ETF (MUB) that has a 1.81% dividend yield.

I’ll discuss other, higher yielding assets in a future blog post.

Regardless, you need to be invested in something with a dividend yield greater than 0% to derive any benefit from this whatsoever.

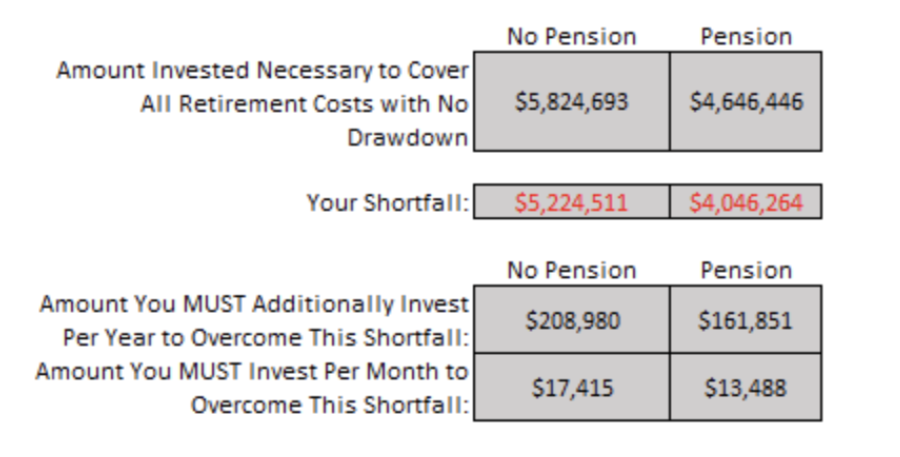

Once you’ve put in this number, the section of the spreadsheet pictured below will tell you how much you need to have invested, yielding your selected amount, in order to avoid ever drawing down from your principal, whether you’re taking a pension/Social Security or not. Having this amount of money will create a truly “passive retirement” income that more than covers all your expenses:

That part of the calculator will also tell you how much (more or less) you need to invest per year to cover the shortfall between your projected nest egg and what you actually need.

If you are on track for a passive retirement AND your retirement nest egg will cover the cost of your full retirement, you’ll see this message telling you how amazing and handsome you are:

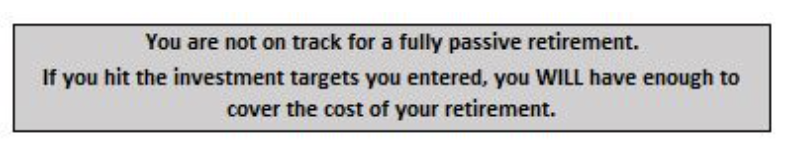

If you are NOT on track for a passive retirement, but your invested retirement nest egg WILL cover the costs regardless if you draw from it, you’ll see this message telling you that everything’s going to be ok:

If you are not on track to retire in any way whatsoever with the number you put in, you will see this message telling you that what you’re currently doing ain’t working, and you should probably do something else and, like, level up your wealth building:

And that’s it!

That’s how you know if what you’re currently doing will let you retire when you want to.

Some Quick Tips and Takeaways From This Exercise

I hope that you’ve found this calculator helpful and insightful…

But I also understand that you could be looking at the numbers and feeling a little disheartened right now.

So let me point out a few quick things that might help you figure out what to do…

If you aren’t investing in SOMETHING now, you will not have enough to retire. End of story. I don’t care if it’s collectible gum wrappers, pick SOMETHING that’s appreciating in value and start buying in every month.

The amount you have to retire on goes up dramatically the longer you put off retirement or the younger you are. This gives your investments more time to appreciate and grow on their own.

The ONE thing that will most dramatically impact your ability to retire (more than your retirement age or your lifestyle expenses) is how much money you’re saving NOW, every month. That’s because every contribution you make also begins growing on its own. If you want to see what it takes to hit your retirement targets, start with this number.

Inflation is a wealth killer. Even a 0.5% change averaged over the years can swing the amount you need to retire by millions of dollars.

Also, here’s an interesting discovery I made about Social Security in this multi-year research process…

You’re allowed to start taking a reduced benefit at age 62, and you’re allowed to get “retirement credits” at age of 70 that boost your Social Security payment amount.

Many analysts and retirement experts say “delay taking Social Security” as long as possible for this reason. But because of inflation, this boost ends up being a wash when it comes to offsetting your retirement costs.

Mathematically, the cost of your retirement works out basically the same if you take Social Security as early as you want…

And in fact, taking Social Security earlier might offset the cost of your retirement more.

Especially if you invest all the money you’re receiving from it.

Ok. That’s it.

If you made it this far, I want to commend and thank you.

I truly, sincerely hope that this calculator I built helps you plan for retirement just a little bit easier and set the right goals for yourself…

And I hope that the advice and information I provide in this newsletter and on DIYwealth.com helps you hit those goals.