How to Supercharge Your Returns Using LEAPS

The date was February 18th, 2021 — 12:15 pm.

Speaking through his computer microphone, one of the most successful investors of 2021 was testifying before Congress.

Many famous money managers have testified in the past, but this time was different.

The person in question wasn't a billionaire CEO or a hedge fund manager.

Nor did he even have a Wall Street background.

He was a 35-year-old former employee of a Boston-based insurance company, as well as a part-time investor.

His name was Keith Gill. And occasionally, Gill would write about his trades online.

In other words, he was a normal person, just like you or me.

Yet, this seemingly ordinary American managed to turn a $54,000 investment into as much as $48 million in two years.

How?

The key to Gill’s success was a specific investing strategy that lets investors multiply the earning potential of specific investments — like stocks or commodities…

While also reducing how much money an investor needs to have in the market at any one period of time.That is exactly what Keith Gill did.

Back in 2019, he found a stock that he felt was incredibly undervalued.

However, instead of locking up all his money in the company's shares, Gill did something different.

By using the lucrative investing strategy which I'm going to reveal to you, one that's designed specifically for long-term investors…

Gill was able to leverage the size of his returns several-fold.

Now, as it turned out, the company he invested in was none other than GameStop.

You’ve probably heard about it in the financial news media by now, as its meteoric rise has become the stuff of investing legend.

In just under a month in January 2021, GameStop surged more than 1,914%.

However, what most people forget is that GameStop shot up as much as it did precisely because it was undervalued by the market.

Savvy investors can make a lot of money finding these types of undervalued companies…

But they can multiply their gains if they buy these undervalued stocks… with the right strategy.

That’s exactly what Keith Gill did, eventually inspiring thousands of other investors to start doing the same.

While GameStop rose more than 1,914%...

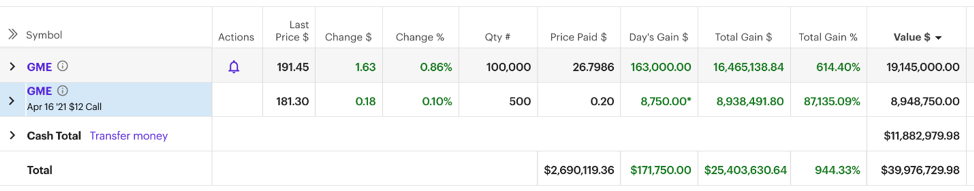

Gill would end up making much as 87,135% on his initial $54,000 investment, drastically outperforming the market.

How?

In the following pages of this report, I’m going to show you the exact strategy that Gill used. And I’ll show you how to apply this strategy to similar scenarios, potentially multiplying your gains over and over again.

But first things first: Let’s quickly recap the situation in which Gill found himself in early 2021. And the opportunity he quickly found in his hands.

The GameStop Saga

For those who closely follow the markets, as I do, the GameStop fad was one of the most fascinating episodes in the history of the markets. And it’s still ongoing.

If you’re unfamiliar with this story, let me recap it for you quickly.

GameStop was an American video game and consumer electronics retailer that saw its glory days in the mid-2000s.

Nowadays, though, most games are downloaded or streamed via the internet. And because GameStop operates physical stores, the SARS-2 pandemic shutdowns and quarantines utterly killed its revenue.

However, Keith Gill looked at GameStop’s financial statements, plans to revamp its business, and insider investors.

He concluded, in mid-2019, that GameStop was drastically undervalued and had a number of future catalysts that could spur its price to grow.

Meaning, he thought the company’s price should be much higher than it was in 2019.

Everyone thought he was a fool for investing in GameStop.

Undeterred, he loaded up on a special type of asset so that he could make a massive bet on GameStop’s future success.

Many times, he was told he should sell, take his gains, walk away.

But he held, and kept buying more options and more shares of GameStop.

In a sense, he combined a version of the “buy and hold and accumulate” strategy of the Legacy Portfolio with a speculative trading strategy, betting heavily on a stock he had high confidence in.

The rest is history.

By the end of January 2021, the price of GameStop went from $17.25 to $347.51 per share in 23 days.

Keith Gill still held GameStop from years before.

While his shares gained an average of 614%...

But the special asset he bought, call option contracts, were up by 87,135%.

Now you probably want to know how Gill invested to achieve his astronomical performance…

So I’ll cover the exact strategy he employed. It’s a strategy any investor can follow to turbocharge returns.

Generating Outsized Returns Using LEAPS

Part of Gill’s strategy with GameStop involved using LEAPS, a special type of asset that lets you supercharge the returns on your portfolio.

Exactly what are LEAPS, you might ask?

In short, LEAPS are a type of option with an expiration date longer than a year.

That’s it.

Like any stock, you can trade in and out of LEAPS anytime you like… you’re not locked into anything.

Now, I want to be clear: I don’t think the kinds of astronomical returns Gill achieved are realistic or common (unless you get incredibly lucky)…

But using LEAPS, Keith Gill was able to make tens of millions of dollars, and could just as well be used for any other stock on the market to realistically double, triple, or even quadruple the returns one could achieve by simply buying shares.

Imagine being able to multiply your investment returns on a portfolio of safe and steady blue-chip stocks…

While reducing your overhaul exposure to the market.

That might sound hard to believe, but these kinds of results are available to retail investors all around the world when they use LEAPS.

The only thing required is a brokerage account and a few minutes of your time.

They are also incredibly simple to use. I’ll be showing you how to buy LEAPS on your brokerage account in as little as a couple of minutes.

Despite this, most retail investors have never even heard of LEAPS before, let alone used them.

So let me share with you exactly how LEAPS work, as well as how much money LEAPS could have made for you over this past year.

As I've said, it's a technique used by some of the best-performing hedge funds in the world to beat the market.

And yet, they’re still so unknown…

Why Most Investors Have Never Heard of LEAPS Before

Despite what most financial experts would have you believe, investing with LEAPS is incredibly simple.

Instead of buying a stock, LEAPS allows you to "copy" the gains of any stock on the market… without actually having to buy that stock.

The idea is that, by using LEAPS, you could keep most of your money tucked away in your brokerage account rather than locked up in the markets.

How is this possible?

To do that, we need to use a specific financial product called an option.

For a lot of people, using options might sound complicated. They definitely can be.

However, if you use the right strategy, options can be incredibly easy to use.

In fact, LEAPS is one of the simplest option strategies out there. You can start using LEAPS with just a few clicks on your brokerage account.

Unfortunately, since many retail investors are scared about using options, powerful trading strategies like LEAPS remain largely unknown.

The truth is, they shouldn't be.

An option is simply a contract that gives the owner the right to buy or sell an asset (like a stock or a commodity) at a future date.

You can buy an option to buy shares of IBM in the future at a certain price called the strike price. Options contracts that let you buy a stock are called call options.

You can also buy an option to sell shares of IBM in the future at a certain price. This is called a put option.

In exchange for buying these options, you pay a small fee upfront to the party who is selling these options contracts. This is called an “option premium.”

Additionally, you can also sell put and call options yourself. You get to collect the fee (or premium) from the person who bought said option when you do this.

The beauty behind options is that they allow investors to "copy" the gains or losses of any stock on the market while only paying a fraction of the upfront cost if you were to buy said stock outright.

But what exactly are LEAPS, and how do they work?

Let me show you exactly…

How LEAPS Can Multiply Your Investment Returns

While most traders use call options for shorter time periods, such as months or weeks…

Using LEAPS is a great long-term option strategy for investors confident that a stock will go up in the long run.

What's more, they have a few big advantages over buying the underlying stock itself.

Let me show you how just how powerful options can be.

For example, let's say stock X is trading at $100. If you want to buy 100 shares, it will cost you $10,000 to do so (excluding brokerage fees).

However, you can buy a call option contract that gives you the option to buy stock X at a $100 strike price. Each call or put option represents 100 shares of any given stock.

Instead, you would have to pay a small fee per share to buy said contract. In this case, let's say that it's $20 per share or a total of $2,000.

In other words, you could mimic the results of $10,000 worth of stock — by only committing $2,000 in a call option.

If stock X doubles to $200 per share, you could exercise your call option to buy 100 shares of stock X at $100 and sell it for $200 on the market—netting you $10,000. Subtract the $2,000 you paid to buy that option, and your profit will be $8,000 ($10,000 - $2,000 = $8,000).

Think about it this way. What sounds better?

Committing $10,000 to make $10,000 in profit…

Or just using $2,000 to make $8,000 in profit?

You'll probably agree that the second option is much more efficient.

Best of all, instead of locking up $10,000 in the stock market for years, you only have to commit $2,000…

Leaving the rest free to use however you wish.

At this point, you might be wondering: “What’s the risk? Surely there must be a downside to using LEAPS.”

The big risk to using LEAPS is the fact that, if they are not profitable by the expiration date of the option, they will expire worthless.

Unlike a stock that can go down for a bit and recover, when options expire worthless they are worth exactly $0.

That’s why I never recommend investing all your money into LEAPS. You should always use a blend of call options and stock, if you think a stock is going to go up significantly over the next year or two.

So what happens if, instead of investing $2,000 into a call option and just keeping your remaining $8,000 in your account…

You bought $2,000 worth of call options and $8,000 of shares?

If a $2,000 call option made you $8,000 in the above scenario…

Then a combination of call options and shares would have $16,000 in profit instead.

Much more than what buying the stock itself would have given you.

This is how call options — and LEAPS — can multiply the earning potential of your investment account, especially when paired with buying shares.

Of course, it's easy to come up with a hypothetical example like this.

So let me show you just a few real-life examples, taken from Legacy stocks in our portfolio, that could have made you multiple fortunes over the past year.

3 Legacy LEAPS Trades That Could Have Made You a Fortune… in a Year or Less

Despite economic worries surrounding the pandemic, our Legacy portfolio has seen some remarkable gains over the course of 2020 to 2021.

For example, take American Express (NYSE: AXP).

It was one of the top-performing Legacy picks this year.

In just one year, shares skyrocketed more than 70.3%.

Enough to turn $10,000 into $17,029, with dividends reinvested.

However, what if instead of just buying $10,000 worth of stock, we bought $10,000 worth of LEAPS instead?

On August 3rd, 2020, you could have bought an 18-month call option with a strike price of $90 and at a price of $15.60 per share.

Considering each option contract represents 100 shares, each contract would cost $1,560.

With $10,000, we could afford to buy six of those call options, totaling $9,360, which represents 600 shares in total.

By August 9th, American Express was trading at $170.80 per share. With a strike price of $90 per share, that would give you a profit of $80.80 per share.

Given our six call options represent 600 shares in total, that comes down to $48,480 in gains. Subtract the initial $9,360 we spent to buy these call options…

And your net profit is $39,120!

That's more than double the $17,029 you would have made by buying American Express stock and reinvesting the dividends.

I think you'll agree, making $39,120 in 12 months is much better than just $17,029.

That's just one of many examples I can show you.

How about Wells Fargo (NYSE: WFC)?

This American bank has become one of Wall Street's favorite financial stocks, with an incredible runup since 2020.

Shares are up more than 99.7% from last year!

That same $10,000 would have turned into $19,972 with dividends reinvested.

But guess how much more you would have made if you bought WFC using LEAPS instead?

A call option with a one-year expiry date at a strike price of $22.50 would cost you $4.80 per share — or $480 per contract.

Using that same $10,000, we could have bought 20 call options — representing 2,000 shares in total — for a total cost of $9,600.

Wells Fargo is trading for $48.70 per share as of August 9th.

With a strike price of $22.50, that works out to a difference of $26.20 per share, or $52,400.

Subtract $9,600, and we have a net profit of $42,800.

Once again, that's more than double the $19,972 you would have made if you just bought Wells Fargo stock.

Or how about Diageo (NYSE: DEO), a British alcohol beverage company?

It's a stock that's up 37.8% since August 3 of 2020 — turning $10,000 into $13,778 with dividends reinvested.

But how much would a LEAPS investment in Diageo be worth?

On August 3rd 2020, a call option with a $145 strike price would cost you $16.10 per share. With $10,000, you could buy a total of six contracts for $9,660, controlling 600 shares.

On August 9th 2021, prices are trading at $198.90. With a $145 strike price, the difference comes to $53.90 per share — or $32,340.

Subtract the $9,660 you spent the purchase said contracts, and you'd be left with $22,680 in profit.

That's almost seven times more than what you would have made just by investing in Diageo stock.

Those are just some of the gains you could have made by using LEAPS alongside our Legacy portfolio picks.

However, as powerful as this LEAPS methodology is, there are a few caveats you should know before you start using them.

When You Should (and Shouldn't) Use LEAPS

As you'd expect, LEAPS are a fantastic way to trade a stock if you expect prices are going to go up.

However, there are some cases when you shouldn't use LEAPS at all.

First, you shouldn’t use LEAPS if you're interested in receiving dividends or shareholder benefits.

While owning the actual stock entitles you to receive these benefits, owning a stock option doesn't.

For that reason, long-term investors that want to compound their wealth and earn a reoccurring, passive income through dividends won't benefit from using LEAPS.

For that reason, I recommend LEAPS specifically for investors looking for high-growth returns, usually within a 1-2 year period, especially during a bull market.

However, there's another thing you should keep in mind when using any time of long-term option strategy.

LEAPS typically have a higher fee or premium cost compared to shorter-term options.

After all, a short-term option has less time for prices to swing up or down, so there's not as much risk for the party selling the option.

However, since LEAPS last for over a year, a stock has a lot more room to move, up or down.

For that reason, you're going to want to buy an option for a stock that will grow at a fast enough rate to make a profit on your trade.

At the same time, however, you also don't want a stock that's volatile enough that it could collapse during that 1-2-year period, either.

In other words, you're looking for a safe, long-term stock that isn't going to crash, but with sufficient growth potential that it will outperform the market.

This is exactly the kind of opportunity I’m seeking in the Legacy Growth Portfolio.

How to Make a LEAPS Trade Today

LEAPS are incredibly powerful, but they also happen to be very easy to set up.

The only thing you'll need is a brokerage account. If you've never bought an option before, I am going to show you, step-by-step, the exact process that you would use on your own account.

Step 1: Go to your brokerage account.

Step 2: Type in the symbol of the stock you want to buy a call option for.

In this example, I'm going to use Wells Fargo, whose ticker symbol is WFC.

Below is an example from TD Ameritrade's thinkorswim platform. Your brokerage may look different, but the process will be the same.

Notice the red circle. You will want to open up the option chain on the stock, where you will find the specific option contract you are looking for.

Step 3: Find the option that matches the strike price and expiration date that you are looking for.

For a LEAPS option, you're going to want to look for one with an expiration date that is one year or longer.

In the options market, you'll typically see more timeframes in the short-to-mid-term, while fewer expiration options for longer-term contracts. Whereas you can find options dated one week, one month, or one quarter out from the current date, longer-term option contracts will typically be in one or two-year expiration dates.

In this case, we've opened up options that expire on June 17th, 2022, and January 20th, 2023.

In this example, let's buy a Wells Fargo call option that expires on January 20th, 2023, with a strike price of $47.50.

Step 4: Click on the option to initiate a buy order.

Step 5: Fill out the appropriate information, including the number of contracts you want to buy as well as your limit price.

Note: Because the price of an option tends to fluctuate, you always want to use a limit order when trading options.

Let us assume that our limit price is $7.75 on a $47.50 strike price call option and that we're buying 10 calls. Here's what the call buy order would look like.

Step 6: Before you click the buy button, confirm that everything is correct.

You are "buying to open."

You are buying a call contract and not a put.

The call contract is the same strike price and expiration date as our recommendation.

Your limit order is at or less than our recommended buy-up-to-price.

See the picture below. The items to check are circled in red.

Once you've pressed the buy button, you're done. Congratulations — you've just bought your first LEAPS call option.

Now, I understand this can be an intimidating process if you’re doing this for the first time…

That’s why, as a part of your membership, I’ll be walking alongside you, week-by-week, showing you exactly what to buy, how to buy it, and when to sell it.

I look forward to helping you turbocharge your portfolio returns. See you soon!